The Cook Inlet oil and gas investments have seen significant growth since Alaska began the tax credit program and now local companies are anticipating possible changes.

Senator Cathy Giessel convened the Senate Oil and Gas Tax Credit Working Group ahead of Governor Bill Walker’s budget that is set to be revealed soon.

Sen. Giessel: “We have been told he will be proposing some changes in the tax credit, tax rebate program so my purpose for convening this group was to create a database for the legislature. This subject is too big to try to wrestle during a 90 day session when we have a budget to deal with.”

A recommendation of the working group is to phase in any changes to the program.

Group member Senator Peter Micciche says another recommendation is solidifying the program’s 4 percent mandatory tax floor that is included in SB 21.

Sen. Micciche: “One of the things that we need to protect the state against is the use of the loss-carry-forward provision which means if a company has had losses they can carry them forward and that can actually bring you below that 4% floor.”

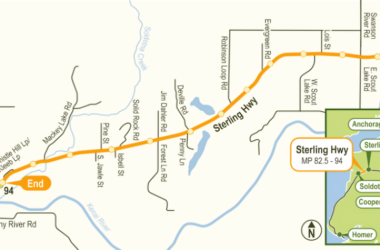

Bluecrest Energy’s Larry Burgess has already said that their gas development in Anchor Point’s Cosmopolitan Unit is on hold pending changes….

Burgess: “And I can tell you without any question that if the tax structure changes in a way that is not favorable to the economics of this offshore project, it will not take place.”

Furie Operating Alaska came online with significant gas production in November.

Vice President Bruce Webb says while they don’t have plans to pause any developments if the tax credits are ended, the program makes new explorations “less risky and more economical”.